Last year we ran several articles on the TI Provider Datamyne, Lisa Wallerstein the VP Product Development /Marketing and the announcement of their new interface, Datamyne 2.0. In this last week’s series of articles, I focused on the specifics of their TI product following an in-depth demo and review.

I must admit that recently, while making my rounds with each top-tier TI provider and getting a deeper look at their products, my viewpoint is changing.

What I am discovering is that there is no one best product and TI provider out there. Each has its own particular approach, technologies, interface, data sources, value added services, and pricing model that make it the best solution for certain niche or target markets.

After reviewing Datamyne’s interface, I can confidently state that it represents perhaps the best analytical user interface by which to “slice and dice” the U.S. Customs data that I have seen thus far. It’s a trade analyst’s dream machine.

If you’re looking for a robust TI product that is straightforward and relatively easy to use by which to perform heavy-duty analytics on the U.S. Customs Data, you definitely need to check out Datamyne.

WTD Editorial Note: I’d also like to address an important issue that has come up on several occasions. I have been accused by some of being overly biased toward PIERS. In a number of articles and in handfuls of instances it has been noted that I have stated that PIERS products are the best. By and large, I think the accusation has been well founded.

To be honest, one of the reasons for my bias is that the TI products we developed at CenTradeX (IMHO) were vastly superior (in aspects of innovation, UI access, data integration, graphic delivery and performance) in comparison to any other TI product. PIERS acquired these assets last year. Furthermore, the team of superb technologists I worked closely with for many years also migrated to PIERS. Therefore my high esteem has been transferred or credited to PIERS posthumously, so to speak.

Secondly though, having dealt closely with the new management team at UBM Global Trade /PIERS for many months during the due diligence process and afterwards (being somewhat privy to their “thought engineering” and witnessing the changes they are implementing) I have gained tremendous respect for them. Further, they have several proprietary databases that are “untouchable” by competitors. They have roots in history and experience that go back over 100 years. They have worked with Customs data along with the nuances of refinement and standardization for many decades.

So, with regards to my previously perceived biases, I hereby recant my previous position that there is ONE best company and ONE consummate Trade Intelligence platform. Vive la différence!

13/05/2012

13/05/2012

Since I thus recanted of my previous bias, it seemed an appropriate amends to publish a well founded bias i received via e-mail last night on the eve of this article from a very enthusiastic devotee within Datamyne’s employ. Although too late to incorporate within the series, I think he has made some good points which are worth mentioning.

On Thu, Sep 15, 2011 at 7:03 PM, C Haddock- Datamyne wrote:

Robert-

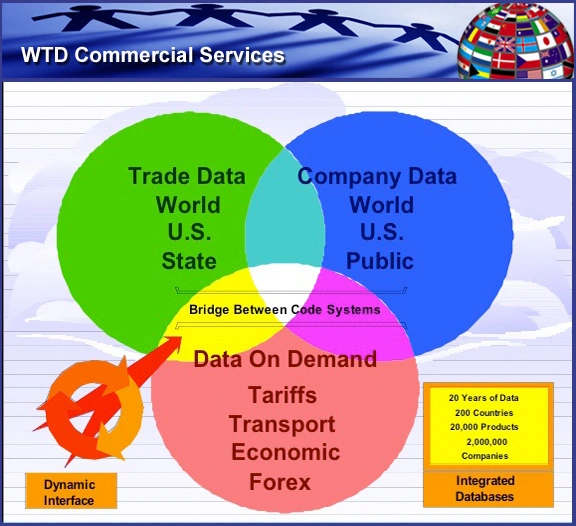

Thanks for the informative read on the articles. I noticed that a heavy amount is spent on just US Import data though reference is given to “competitive strengths that were mentioned” to you when speaking of our additional countries. I felt compelled to share that having access to multiple countries globally provides an essential, even deal-breaker, for both our private and public sector clients. For example, we have contracts with certain high level government officials who utilize our international trade data to intercept illegal drug trafficking by using our Bolivia and Chilean data for shipments going to the far East. Also multiple companies only subscribe to countries such as India, the EU and the Chinese trade databases.

The reason I wanted to share is because I noticed there were 4 parts for both IG and Panjiva, and if you were inclined to extend the coverage of DM, a 4th part could be perhaps one of the most powerful benefits that truly makes us a valuable global data provider. The other two companies have you profiled have US import trade data, and while that is the hottest platform on the market for the West, it represents a portion of our global platform and we effectively have no competitor on a global level except maybe PIERS who would come in a close second (imo).

Thus in line with the name of your organization, World Trade Daily, it seems that DM would fit more congruently with your audience as we not only have US Import data, but a truly World (Global) Trade database. Just some thoughts to share.

In any case, I do not intend in any way to direct you on your profiles (though perhaps influence a little 🙂 ), I simply feel passionately about our strengths and have personal experience with many high level companies and other groups that rely heavily on our global platform (aside form US Import data) as much as the current thousands of users do with our US Import data. We can be compared with our import of US trade data with other companies, but on a global scale, I believe we stand alone.

Respectfully,

Chris Haddock

Manager of Customer Care