When I asked Ryan how he saw Import Genius relative to other TI providers and what were Import Genuis’ competitive strengths, he recounted the following:

- Innovation and product development.

- Visual Mapping utility.

- Customer service with 24/7 a day phone support.

- Overall cheaper than their competitors so you get more for your money.

- Easy to use search tools created for “ordinary” people.

- LOVE: They demonstrate more practical care for their customers.

Customer love is sweet

Since I’m not a customer (nor have I spoken with Import Genius customers), I can’t speak to the reality of the last claim. I will, however, say that talking to Ryan on the phone for an hour or so and “feeling” the love, passion and conviction that he has for his company and product… well, he made a believer out of me.

As far as customers are concerned, Mr. Petersen said that about half are composed of small to medium-sized importers. Another 30-40% are overseas suppliers looking for U.S. buyers (mostly from India and China). The third segment is primarily composed of freight forwarders (looking for prospects) and lawyers (checking for intellectual property violations and compliance type issues).

The two biggest areas of improvement needed to the Import Genius interface are:

- Data normalization and refinement. U.S. Customs data needs a lot of tender loving care and many refinement processes in order to yield its succulent treasures. Despite good intentions, passion, vision and street smarts, the beginning, middle and end of the matter has to be about the DATA.

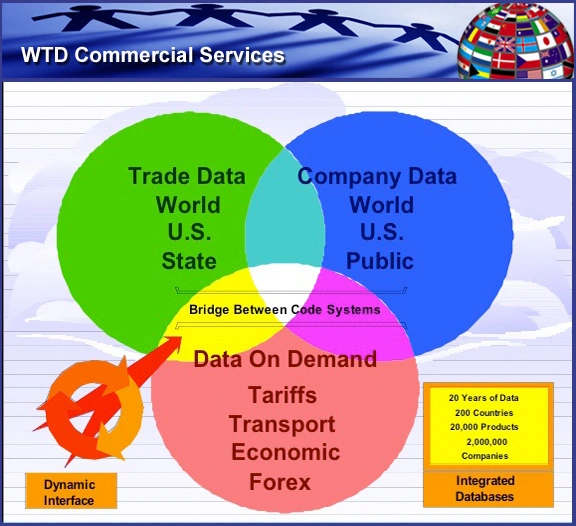

- Dimensionality and depth. Much of Trade Intelligence is about connecting the dots. The greater number of important dots you connect, the greater the smarts. Statistical data, reverential data, company data, third-party credit data, tariff data, there are a plethora of sources and lots of dots to connect depending up on your particular business application.

I also don’t know IG revenues compared to those of the other Top Tier TI providers. They didn’t start with VC partners like Panjiva or Datamyne did. They don’t have the infrastructure and history of PIERS. However, if they can figure out a way to better refine the data, connect the dots and get more traction in the marketplace, I’d say they’d be pretty dangerous… to their competitors that is.

03/06/2012

03/06/2012

Comments are closed.