From Euromonitor: China Leads Global Manufacturing Output. In 2010, China was the world’s largest manufacturer and stands to maintain this in 2011. Low labour costs and economic growth have allowed China to become the destination of choice for global businesses looking for offshore manufacturing. Consumers have benefitted from the resulting competition for production costs. However, China’s one-child policy and rising wages are restricting manufacturing and labour growth, while the country has earned the unwanted tag as the world’s low-quality producer.

China’s total manufacturing production expanded by 107.9% in real terms over 2005-2010, amounting to US$10.2 trillion, the largest total worldwide, and more than double that of second-placed USA. The country’s large manufacturing base has been key in attracting foreign businesses and boosting the domestic labour market, while Chinese consumers have benefited from lower prices on locally produced goods. Nonetheless, high rates of inflation, growing wages and a shift in government policy are beginning to erode China’s manufacturing edge, with businesses increasingly turning to cheaper Asia Pacific producers. With manufacturing making up 29.5% of GDP in 2010, one of the highest ratios in the world, China remains vulnerable to external demand shocks.

China’s total manufacturing production expanded by 107.9% in real terms over 2005-2010, amounting to US$10.2 trillion, the largest total worldwide, and more than double that of second-placed USA. The country’s large manufacturing base has been key in attracting foreign businesses and boosting the domestic labour market, while Chinese consumers have benefited from lower prices on locally produced goods. Nonetheless, high rates of inflation, growing wages and a shift in government policy are beginning to erode China’s manufacturing edge, with businesses increasingly turning to cheaper Asia Pacific producers. With manufacturing making up 29.5% of GDP in 2010, one of the highest ratios in the world, China remains vulnerable to external demand shocks.

However, China is losing its advantage as a low cost environment for labour. The country’s one-child policy is resulting in shortages of labour which permits workers the leverage to demand better wages. Rapid population aging is narrowing the labour pool, while high inflation is increasing export and transportation costs. Wages per hour in manufacturing increased by 63.1% in real terms over 2005-2010.

However, China is losing its advantage as a low cost environment for labour. The country’s one-child policy is resulting in shortages of labour which permits workers the leverage to demand better wages. Rapid population aging is narrowing the labour pool, while high inflation is increasing export and transportation costs. Wages per hour in manufacturing increased by 63.1% in real terms over 2005-2010.

From Tradeology (ITA): The Manufacturing Council: A Public/Private Sector Partnership for Progress.

Why is the manufacturing sector so important? Its because, historically, it has been a key to U.S. economic growth, provided a ticket to the middle-class for American workers, and been home to some of America’s greatest innovations. Looking ahead, as Secretary Bryson recently told the U.S. Chamber of Commerce, “without a strong manufacturing base, we can’t create enough good jobs to sustain a strong middle class. And without a strong middle class, we cannot be a strong country.” 334,000 manufacturing jobs have been created over the last two years. In the third quarter of 2011, manufacturing profits were up more than 7 percent compared to the first quarter.

ITA is committed to keeping this momentum going in a variety of ways including helping U.S. manufacturers reach new markets.

- Only 1 percent of U.S. businesses export. Of those that do, 58 percent export to only one market. There is potential for U.S. manufacturers to do so much more.

- With efforts like the New Market Exporter Initiative, ITA is working with private sector partners — like the National Association of Manufacturers— to provide U.S. businesses with the support they need to reach new markets and new customers.

29/01/2012

29/01/2012

From Panjiva, courtesy of Libby Fortier, Version 2.0 Communications:

From Panjiva, courtesy of Libby Fortier, Version 2.0 Communications:  “A healthy housing market is key to the revival of U.S. containerized imports growth as many of the goods consumers purchase to furnish a home are imported,” Moreno said. He pointed to additional expansion in November in cooking and heat appliances, lamps and parts, and kitchenware. Growth in these other commodities contributed to the increase in imports from China—up 4.1% Y-o-Y, the country’s first rise in eight months. Demand for local lumber was a key factor in a surprising November increase of 515% in imports from Canada.

“A healthy housing market is key to the revival of U.S. containerized imports growth as many of the goods consumers purchase to furnish a home are imported,” Moreno said. He pointed to additional expansion in November in cooking and heat appliances, lamps and parts, and kitchenware. Growth in these other commodities contributed to the increase in imports from China—up 4.1% Y-o-Y, the country’s first rise in eight months. Demand for local lumber was a key factor in a surprising November increase of 515% in imports from Canada.

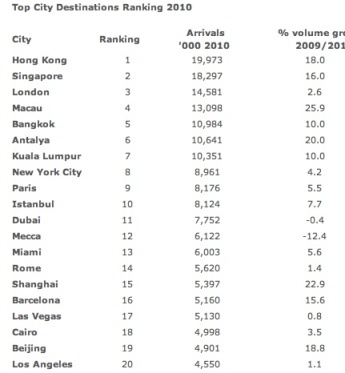

Top three destinations

Top three destinations

Economic impact

Economic impact

From PIERS:

From PIERS: