Consultation, Application Development & Project Management

I am available on an hourly, daily or project basis, to consult and lead during the many facets of developing, integrating and applying trade intelligence.

By the day : Contact me directly via email. Rate: $1,000 to $2,000 per day ($125 to $250 per hour), plus expenses (billed in 1/2 day increments).

By the project (over 10 billable days): Dependent upon the nature and scope of the project, a discount in my daily rate may apply. I also have several handfuls of excellent technologists, writers/editors and graphic design folks at my disposal if needed for the project. Rates vary from $35 to $125 per hour for their time & expertise. There are few things I enjoy more than directing a team of competent professionals as we work together on an innovative project toward an inspired objective.

Examples of Customized Trade Applications

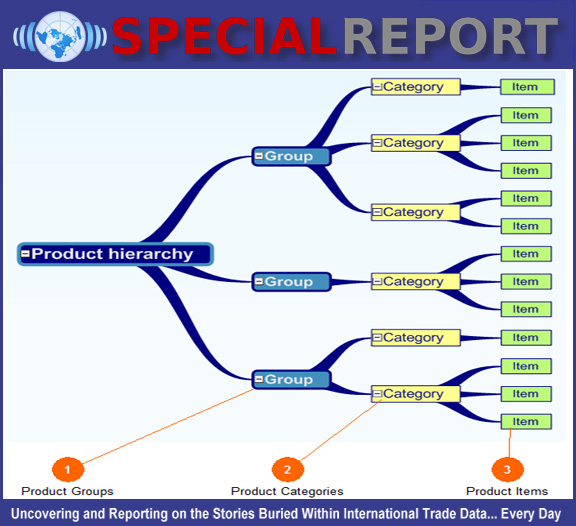

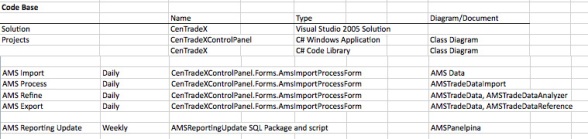

Besides developing innovative trade intelligence applications that were ultimately acquired by the largest T.I. Provider on the planet, we worked with a couple of dozen organizations along the way developing custom trade applications that were designed and integrated for their specific requirements and target markets. Included among them are the following:

Besides developing innovative trade intelligence applications that were ultimately acquired by the largest T.I. Provider on the planet, we worked with a couple of dozen organizations along the way developing custom trade applications that were designed and integrated for their specific requirements and target markets. Included among them are the following:

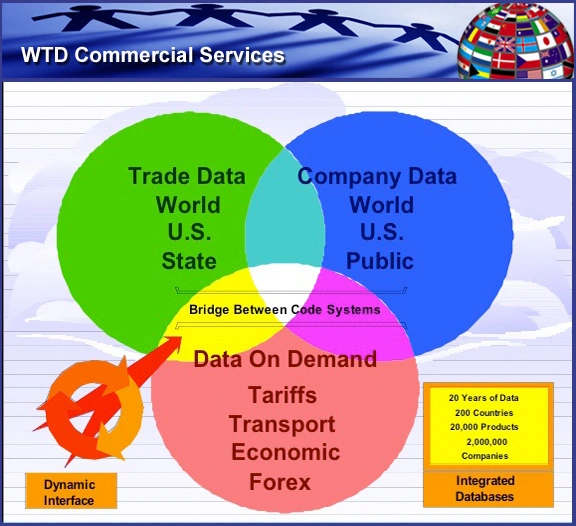

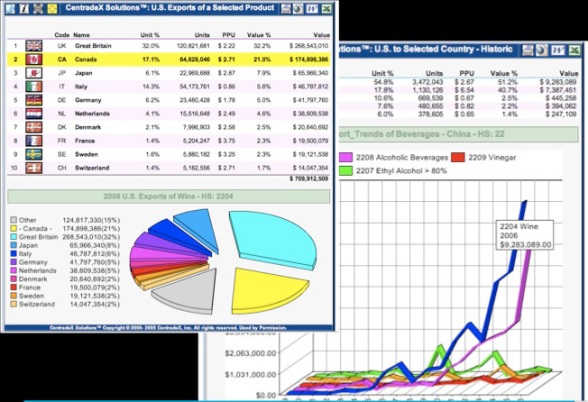

Our first interface, named “Trade Made Easy”, later renamed CenTradeX 2.0., was a colorful interactive feast of statistical interplay (over 1 billion dynamically generated charts and graphs) wherein users would select a “X” axis (one of 25,000 products) and a “Y” axis (one of 200 listed countries) and thereupon an entire website would be magically created from which they could retrieve a plethora of information. This application fared very well within academic circles.

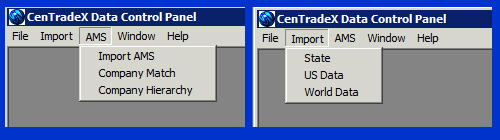

G.E.M.S. Developed for the U.S.D.A. Foreign Agricultural Service for their 50 state marketing offices (customized for each of their four regions) to help U.S. Food exporters to find and market overseas. GEMS integrated Statistical, Company, Tariff, Shipping costs and foreign exchange rates into one easy to use system.

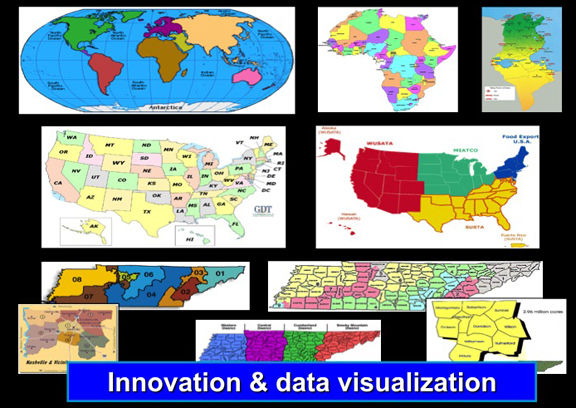

S.E.E.D.S. State Export & Economic Development System. Developed, then customized for many state trade offices including California, Pennsylvania, Alabama, Oklahoma, Tennessee, Virginia and more. The user interface was designed to work seamlessly within the look and feel of the respective states’ websites therefore “attributing” tremendous technological and information power to the state and providing valuable services to their consistency.

SEEDS was further customized for the WTCA (World Trade Centers Association) for their 300 WTC’s in 100 countries servicing 1 million members. Each member trade center’s U.I. (user interface) was regionalized to present data pertinent to their city, state, country, industries and companies. In addition, automatically generated reporting – incorporated into each members interface – helped generate revenue from the sales of reports and services.

Our development work went beyond simply modifying our interface to the “style sheets” of our respective customers. We specialized in doing “innovative things with international trade data” to meet the specific requirements and needs of each client. For MSU/Global Edge (the most visited international info. website on the planet at the time) we constructed interactive industry, country and state “channels”.

For the State of Pennsylvania (with the most “funded” state international trade office at the time) we developed an advanced interactive platform for their exporting companies throughout the state that lead them – step-by-step – through a diagnostic tool that evaluated their export readiness, directed them to the appropriate resources and gave them a 20 plus customized comprehensive global market report on their selected product.

In collaboration with E.C.R.M and Walmart we developed and integrated several “industry channels” within their Marketgate application suite, which provided trade and market intelligence to U.S. retail sourcing professionals and suppliers. Incorporated within the system was the capability to generate ad-hoc “on the fly” reports based upon the users selected product – source country pair.

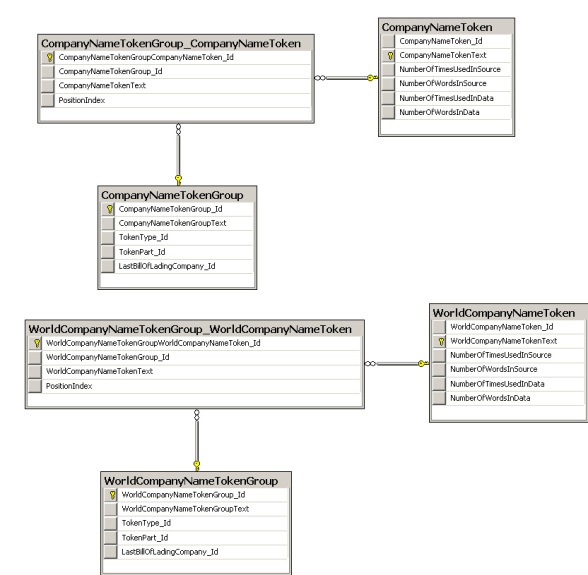

Working with Panalpina (a long time CenTradeX customer) and other logistics providers we developed a geographically oriented prospecting tool which was later named Prospects. Under the hood of this powerful application was our superior capacity to geo-code the transactional data we received from U.S. Customs – connected with huge data repository of International companies.

There were handfuls of other clients, big and small that we worked with to develop business solutions for their international trade service. Much innovation has been done within the world of trade innovation, but there is still very very much to do. It is a trillion-dollar industry that still operates in many ways like we still exist in the industrial age. I’d love to help you develop and refine the technological tools you possess to better compete and succeed in the global market place.

31/07/2013

31/07/2013

The location – company match utility also can be used to link unlinked branch locations to their respective parent company or regional/ divisional headquarters. Furthermore, it can process and link a proprietary client’s database of customers as well. In this fashion, one can monitor customer’s trading activity and supply chain operations on a daily basis! This information can be incorporated into a web application which is distributed within the secure company intranet or protected proprietary web site. An example is Panalpina, one of our previous (CenTradeX) clients wherein we integrated their proprietary information into a customized web application for distribution to their regional sales offices.

The location – company match utility also can be used to link unlinked branch locations to their respective parent company or regional/ divisional headquarters. Furthermore, it can process and link a proprietary client’s database of customers as well. In this fashion, one can monitor customer’s trading activity and supply chain operations on a daily basis! This information can be incorporated into a web application which is distributed within the secure company intranet or protected proprietary web site. An example is Panalpina, one of our previous (CenTradeX) clients wherein we integrated their proprietary information into a customized web application for distribution to their regional sales offices.

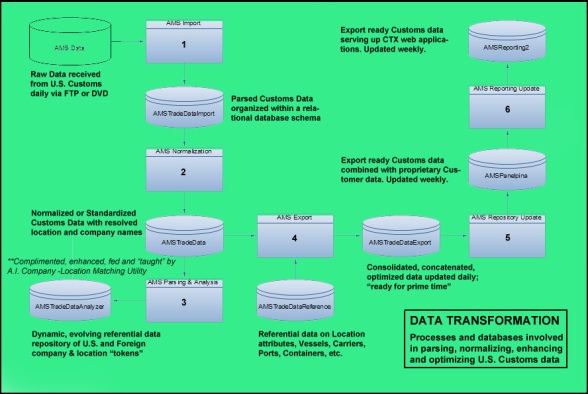

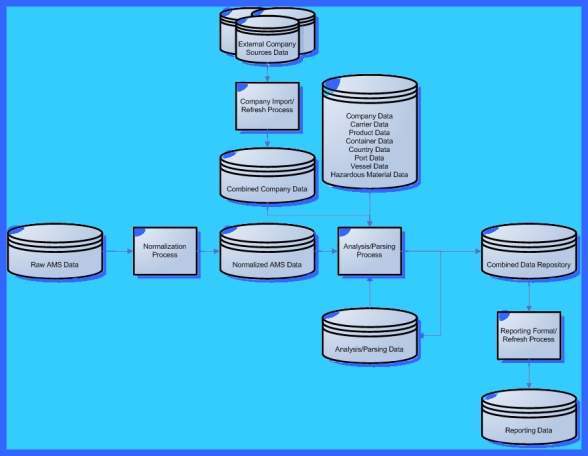

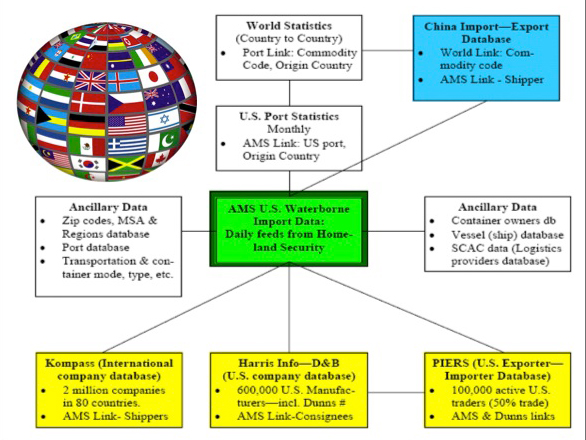

I refer to U.S. Customs waterborne import manifest data as the “base” data because it is considered (by myself and many others) the most intrinsically valuable, if challenging, international trade data set available. It’s daily. It’s transactional. The U.S. is considered the easiest market to access. It contains a wealth of detailed information about the global supply chain. It represents $1 trillion dollars of trade a year.

I refer to U.S. Customs waterborne import manifest data as the “base” data because it is considered (by myself and many others) the most intrinsically valuable, if challenging, international trade data set available. It’s daily. It’s transactional. The U.S. is considered the easiest market to access. It contains a wealth of detailed information about the global supply chain. It represents $1 trillion dollars of trade a year.

There are a number of previous articles wherein I have referred to other shortcomings and challenges inherent with the understanding and applying U.S. Customs data. Please note the following:

There are a number of previous articles wherein I have referred to other shortcomings and challenges inherent with the understanding and applying U.S. Customs data. Please note the following: We also published several dozen articles focusing on the current Trade Intelligence purveyors of Customs data. The links provided below will pull up a handful of articles each – for a particular company, group of companies (in cases where they are “minor, second tier” providers) and summary evaluations. You can also find these articles, and others grouped by various categories, on the top navigation menu of this site.

We also published several dozen articles focusing on the current Trade Intelligence purveyors of Customs data. The links provided below will pull up a handful of articles each – for a particular company, group of companies (in cases where they are “minor, second tier” providers) and summary evaluations. You can also find these articles, and others grouped by various categories, on the top navigation menu of this site.

If not accounted for, you have multiple (and inaccurate) shipments counts. The difficulty is that the only way to adequately correct the problem is to go back into already processed and published data to completely erase and replace the previous record or retain the inaccuracy.

If not accounted for, you have multiple (and inaccurate) shipments counts. The difficulty is that the only way to adequately correct the problem is to go back into already processed and published data to completely erase and replace the previous record or retain the inaccuracy.

Unfortunately, U.S. Customs data and U.S. Census data are asynchronous in many important ways. For reasons beyond the scope of this article, it is impossible to take a record of all waterborne shipments for the month of January from U.S. Customs and seamlessly overlay it with the aggregate statistical record of imports provided by U.S. Census. Further, the HS product categorization system is many times either too specific or too broad to apply.

Unfortunately, U.S. Customs data and U.S. Census data are asynchronous in many important ways. For reasons beyond the scope of this article, it is impossible to take a record of all waterborne shipments for the month of January from U.S. Customs and seamlessly overlay it with the aggregate statistical record of imports provided by U.S. Census. Further, the HS product categorization system is many times either too specific or too broad to apply. How? Several methods. Although presumably “suppressed”, tens of thousands of transactions slip through the filtering methods applied by U.S. Customs technologies. Port pairs (matching foreign port with U.S. port) for a particular product also yield significant dividends. The “product description” and “marks and numbers” fields contained on the shipping manifest sometimes contain references to either Wal-Mart or one of its known suppliers. Product identification information – SKUs, trademarks, etc.- are also sometimes found.

How? Several methods. Although presumably “suppressed”, tens of thousands of transactions slip through the filtering methods applied by U.S. Customs technologies. Port pairs (matching foreign port with U.S. port) for a particular product also yield significant dividends. The “product description” and “marks and numbers” fields contained on the shipping manifest sometimes contain references to either Wal-Mart or one of its known suppliers. Product identification information – SKUs, trademarks, etc.- are also sometimes found.

To understand what you can and can’t get from U.S. Customs data… we need to dig into what it is and why it is… what it has and what it doesn’t have… what current T.I. providers are doing to enhance the base data… where the holes are and how best to fill them.

To understand what you can and can’t get from U.S. Customs data… we need to dig into what it is and why it is… what it has and what it doesn’t have… what current T.I. providers are doing to enhance the base data… where the holes are and how best to fill them.